Reorder Business Checks

Here at the Business Checks Catalog we can help you save time and money by introducing you to the major players…

Read More »

Business Checks with Free Shipping

Enable your business to “Continue Moving Forward” with this Holiday “Free Shipping” Special from Business Checks Unlimited.

Read More »

Dental Record Forms for Your Dentistry Office

Ease your workload while maintaining precise records and save money with these dental record forms. Accurate record keeping for patients and procedures…

Read More »

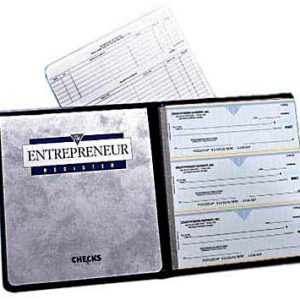

Entrepreneur Checks and Accessories

Compact business checks meet your needs affordably. These Entrepreneur Checks are similar to personal checks but on a larger scale. Each component…

Read More »

High Security Business Checks

You can achieve an added measure of peace of mind by using High Security Business Checks.

Read More »

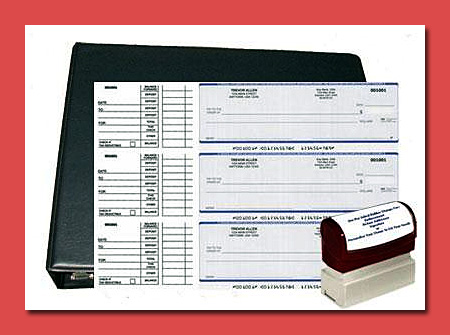

DeskSet Checks for Your Office

These deskset checks, or desk set checks, make check writing easy for the small business owner. Produced three-to-a-page…

Read More »